Today we’d like to introduce you to Don Eggert.

Hi Don, so excited to have you on the platform. So before we get into questions about your work-life, maybe you can bring our readers up to speed on your story and how you got to where you are today?

As a pioneer in the global Microfinance and FinTech industries, I built and grew Kredits, the first banking software to natively support every microfinance methodology. Microfinance is an industry designed to help alleviate poverty by providing financial services to the poor. Kredits is a portfolio management software I programmed from the ground up and a company I cofounded to implement and support it. Over the past 25 years, Kredits has supported microfinance organizations in 33 countries on five continents.

My story began when I graduated college with a bachelor of arts in Physics and–unlike the rest of my family–decided not to pursue graduate school. I felt like my academic interests were too broad to specialize. But that left me a bit aimless. Needing some kind of direction, I made a vague pledge to myself to pursue a career that would somehow benefit the world. Or at least not harm it too much. Of course, that’s easier said than done.

After a lot of self reflection, I determined to begin my career as a mechanical engineer working in the energy efficiency and alternative energy fields. That satisfied my desire to do useful work. But I hadn’t actually studied engineering, which meant I would need to learn on the job. I didn’t know it at the time, but that would define the rest of my life: continually learning new subjects.

My first big engineering project out of college was to help electrify a rural village in Nicaragua by repairing a small hydroelectric generator. That project involved learning Spanish, spending five months in Central America, and navigating the Sandinista / Contra war (it was 1989). I returned to the U.S. and completed a number of energy efficiency projects over the next decade. Those included helping reduce energy consumption at a hospital in Missouri, a mall in Arizona, the largest bank in Mexico, and several Samsung factories in Korea. All this time I kept studying and learning engineering.

In 1997, I finally cemented my status as a mechanical engineer and earned a Professional Engineer’s license. That same year, my wife landed her dream job of setting up a new microfinance lending program in Kazakhstan, an underdeveloped former Soviet republic that was just beginning to embrace capitalism. We both moved to the other side of the world and I began working remotely. But this was before Google was founded and long before the iPhone was invented. Technology was pretty basic and the houses around our apartment burned coal to keep warm. I soon found that the unreliable dial-up internet and the 12.5-hour time difference made remote work very difficult. After 21 hours of travel back to the U.S. to work on an energy-efficiency project, I decided against being a digital nomad. For the time being.

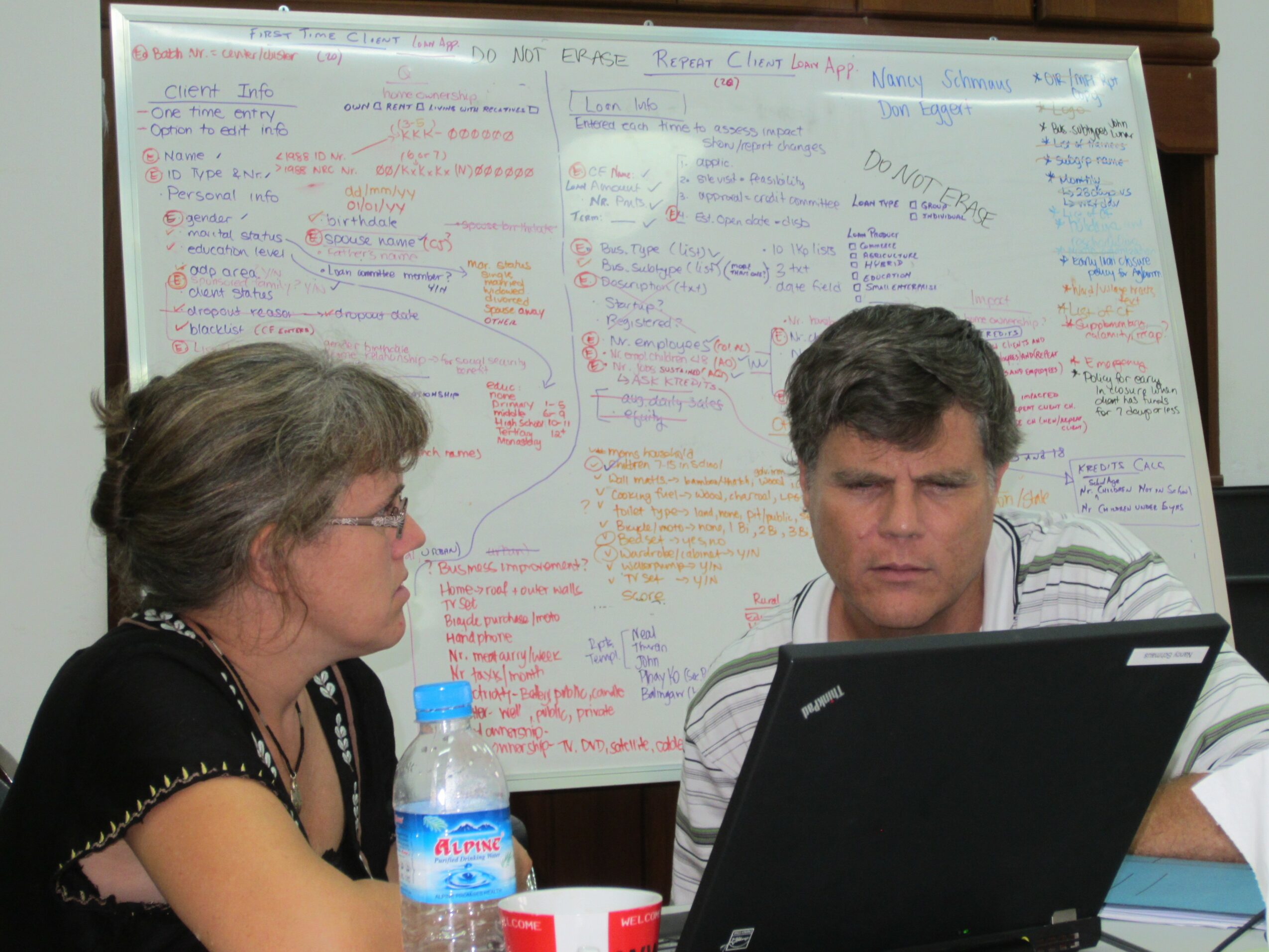

It was about this time that my wife discovered there was no software available to manage her organization’s growing loan portfolio. With little other work to do, I decided to switch careers and teach myself to program. With my wife’s help I began developing loan-tracking software for her organization with an eye toward the global microfinance industry. Over the next 3 years I managed to produce a stable application and install it for her organization’s network of microfinance institutions in four countries. Then we got pregnant and decided to move back to the U.S. With a lot of hope (and not much else), we moved to Salt Lake City to try to make a career out of our software. The next year was a whirlwind: we had our first child, moved to a new city, bought our first house, founded our first company, and completed the company’s first implementations (in Serbia).

We named our software Kredits and gradually built a client base across developing and transitioning economies around the world. We were the first microfinance software installed in many countries including Bosnia, Afghanistan, China, and Myanmar. We were also the first microfinance software to operate in a dozen different languages with complex character sets like Farsi, Khmer, and Chinese. In the early 2000’s my wife and I traveled like digital nomads with our small children to nearly all of the countries where Kredits was implemented. Our company expanded with branch offices in Kyrgyzstan, Serbia, and India, and then it contracted again. Over the past 25 years, as our children grew and matured, we watched the microfinance and FinTech industries evolve dramatically.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

I think being a successful entrepreneur requires a great deal of luck. But, yes, there have been so many struggles. In the early years, I was continually developing and coding new solutions with little instruction or guidance and I often worried they would fail; decades later, I would still be supporting and expanding that same code. As microfinance and technology matured, our solutions had to mature with them. We added support for savings and insurance. I studied and learned accounting and banking and then programmed new teller, cash management, and accounting modules. Before long our software was supporting hundreds of thousands of borrowers across the world and we began adding support for handheld devices and mobile phones.

We faced the challenges of working in remote post-conflict zones like Bosnia, Kosovo, Sierra Leone, and Afghanistan. We tried to stay on top of the news to avoid putting ourselves in too much danger. We also installed our software in remote villages with little infrastructure in countries like Kenya, Myanmar, and Malawi. Some of the users we trained were new to computers. Some offices had to start a generator before they could boot up the computer. We programmed a special system so that data could be regularly consolidated between remote branches by hand-carrying CDs between cities.

But our biggest challenge was to raise two young children and grow an international company at the same time. My wife and I completed most of our overseas implementations together. Each project required us to be on site for up to three months, which meant we had to bring our children along. Since we both worked full time, we needed childcare wherever we went. Fortunately, our clients were very understanding and always supported us. Although bringing our young children (starting at 8 months old) to so many developing countries could be extremely stressful, it was also very rewarding. Our kids grew up with a more global understanding and we experienced other cultures in surprising and interesting ways.

Appreciate you sharing that. What should we know about Kredits?

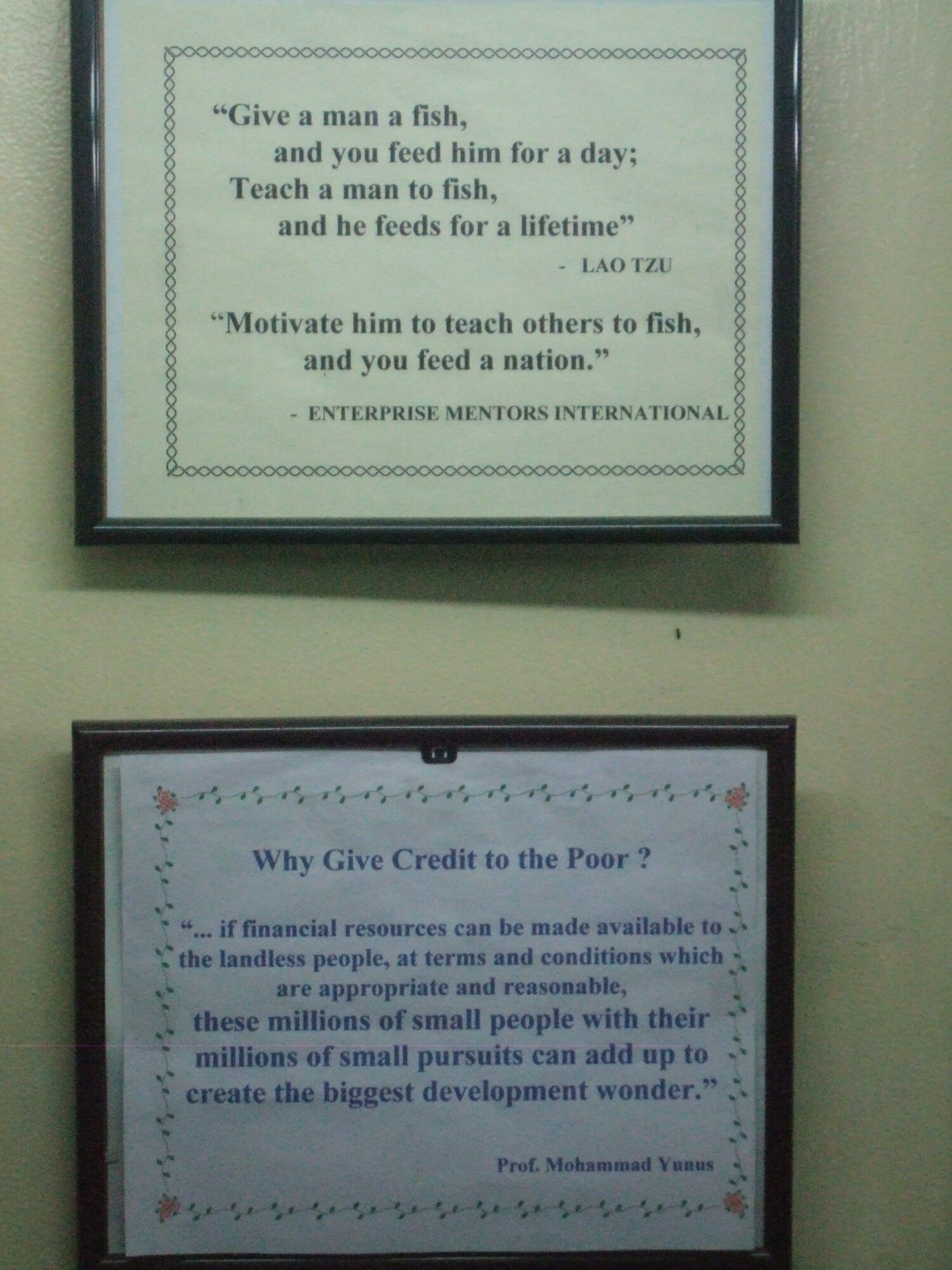

I am most proud that we steadfastly maintained our ethics and our mission to help serve the world’s poor. When you start a new company by yourself, you get to reflect your own aspirations in the company’s ethos. My wife and I started Kredits because we believed in microfinance as a tool for poverty alleviation and we had a desire to reflect our personal ethics in our work. We worked in a lot of countries where bribery is normalized and I think we lost a lot of projects because we never played that game. Over time, as the microfinance industry evolved, many of our counterparts changed their focus toward upscaled banking and wealthier client bases. Had we followed suit, we might have made more money. But looking back on my career, I am proud that we kept to our original mission and continued working toward my old college pledge of somehow trying to benefit the world.

What makes you happy?

I really do enjoy learning new things and it actually brings me joy to solve challenging puzzles under difficult and stressful conditions. I guess programming microfinance software is the perfect career for me. But what really makes me happy is being active out in nature. It helps me reset my mind and body. It’s where I do my best thinking and problem solving. I love backpacking, trail running, mountain biking, Nordic skiing, and backcountry skiing. I also really love listening to music. I am particularly drawn to newly released music because I like challenging my musical and artistic tastes. EDM or techno is usually blasting when I really need to concentrate at work. The rest of the time my tastes are all over the map (as long as the music swings).

Contact Info:

- Website: https://www.Kredits.com

- LinkedIn: https://www.linkedin.com/in/donaldeggert/